Suspicious Filings Prompt Action For Third Time This Tax Season

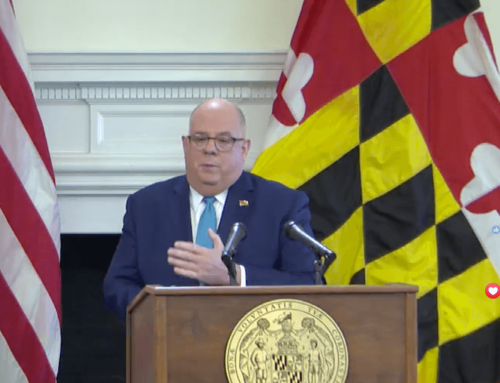

ANNAPOLIS, Md. (April 7, 2017) – In his continuing fight to combat tax fraud and identity theft, Comptroller Peter Franchot today announced that, effective immediately, he has suspended processing electronic tax returns from 15 private tax preparers throughout the region due to a high volume of questionable returns received. Combined with two previous announcements this tax season, returns from 54 tax preparers have been halted.

“We remain steadfast and committed to protecting the integrity of our tax system,” Comptroller Franchot said. “My Questionable Return Detection Team has been tireless in identifying fraudulent returns that attempt to drain state coffers and fleece Maryland’s hardworking citizens.”

Accounting for businesses removed from last year’s list of suspended tax preparers because they are now in compliance, the active number of suspensions stands at 93 tax preparation firms at 111 locations. Since 2007, the Comptroller’s Office has detected and blocked nearly 76,000 fraudulent tax returns worth more than $174.2 million.

The new preparers or businesses notified of the action are:

· Valentine Tax, 328 Jefferson Ave., Brooklyn, NY 11216

· Hitchye Tax & Business Cons Svc, 6350 Frederick Road, Suite C, Catonsville, MD 21228

· Security Tax & Accounting Srv LLC, 1724 Woodlawn Drive, Suite 12, Baltimore MD 21207

· Dieudonne Sossoukpe, 18825 Sparkling Water Drive K, Germantown, MD 20874

· Tax Relief, 5601 McClean Blvd., Baltimore, MD 21214

· Abayomi Olobatuyi, 3310 Shrewsbury Road, Abingdon, MD 21009

· Dem Tax and Accounting Services, 2200 Predella Drive, Silver Spring, MD 20902

· Eze Tax Service LLC, 3601 Hamilton St., Hyattsville, MD 20782

· Global Alliance Solution LLC, 21304 China Aster Court, Germantown, MD 20876

· ARPL Tax Services and More, 6737 Edwards Ave., Windsor Mill, MD 21244

· Metrotax Services, 2443 Linden Lane, Silver Spring, MD 20910

(MORE)

· Holmes Tax Services, 6495 New Hampshire Ave., Suite 120, Hyattsville, MD 20783

· STES Tax Service, 5510 Cherrywood Lane, Greenbelt, MD 20770

· On-Site Tax Services, 1629 E. Baltimore St., Baltimore, MD 21231

· Alleluia Income Tax Service, 1055 Taylor Ave., Suite 212, Towson, MD 21286

Pursuant to his agency’s Memorandum of Understanding (“MOU”) with the Internal Revenue Service, Comptroller Franchot has shared this information with other tax agencies. The Comptroller’s Office also has advised the Office of the Attorney General and the Department of Labor, Licensing and Regulation of the decision, so that they can take any additional appropriate actions.

The suspicious characteristics detected on the tax returns prompting the determination included:

* Business income reported when taxpayers did not own a business.

* Refund amounts requested much higher than previous year tax returns.

* Inflated and/or undocumented business expenses.

* Dependents claimed when taxpayer did not provide required 50 percent support or care.

* Inflated wages and withholding information.

Taxpayers should carefully review their returns for these issues and should be suspicious if a tax preparer deducts fees from their refund, does not sign their tax return, or fails to include their preparer taxpayer identification number “PTIN” on the return. In the event that a taxpayer suspects fraud, they are asked to immediately report the issue to the Comptroller’s Office by calling 1-800-MD-TAXES (1-800-638-2937) or 410-260-7980 in Central Maryland or by emailing TAXHELP@comp.state.md.us.

To review the list of previous preparers from which Comptroller Franchot has suspended processing returns, visit the Comptroller’s website at http://www.marylandtaxes.com/

If taxpayers want to check to see if the Comptroller’s Office is processing returns from a particular tax preparer, or on their status for a previously filed claim, they are asked to contact the Maryland Comptroller’s Office Ombudsman at 410-260-4020 or email at ombudsman@comp.state.md.us.

If taxpayers suspect fraud, they are asked to immediately report the issue to the Comptroller’s Questionable Return Detection Team at QRDT@comp.state.md.us.

Leave A Comment